If you’re also looking for ways to thicken up your wallet, you’ve come to the right place. Redditors have recently been sharing their best frugal habits, so we’ve gathered the most helpful replies below. Enjoy scrolling through, and keep reading to find conversations with Lydia Beiler of Thrifty Frugal Mom, Caitlin Self, MS, CNS, LDN of Frugal Nutrition and Melissa Vera of Adventures of Frugal Mom!

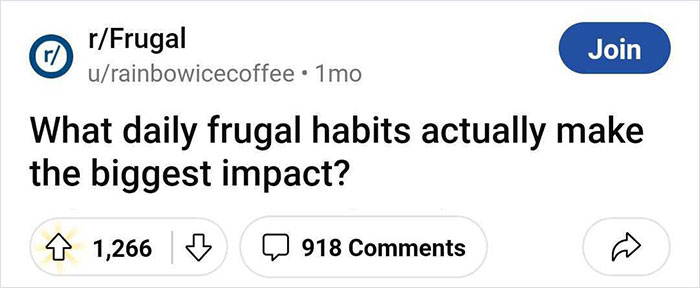

Signal-Fan7335 , Adam/Flickr (not the actual photo) Report

According to Lydia Beiler, aka Thrifty Frugal Mom, some of the habits that have saved her the most money in recent years are “making things from scratch (like homemade Bisquick Mix, caramel frappes, chocolate cake and chocolate syrup); buying things like furniture, toys and baby items used; and avoiding impulse purchases.”

“If you wait several days before buying something, you’ll often realize you don’t really need it that much,” she explained, noting that she’s always tried to live pretty frugally. “And especially so, since my husband and I got married nearly 18 years ago,” she added.

LadyOfThePotato , Sho Hashimoto/Flickr (not the actual photo) Report

trashcanpam , JOE MADONNA/Flickr (Not the actual photo) Report

“The key is to do it consistently, so you can buy more things in bulk and so you use everything you purchase - rather than letting some of it go bad. Learning to cook is one of the best things you can do for your budget, and for your overall health! I’ve been cooking the majority of our meals at home for over a decade, and when we have to tighten the purse strings on our own spending, my food budget is the easiest area for me to quickly modify,” the nutritionist shared.

El_Beakerr , jgbarah/Flickr (not the actual photo) Report

gt0163c , Mr. Leeds/Flickr (not the actual photo) Report

“Always compare prices and seek out deals, discounts, and coupons before making purchases. (Just because you have a coupon doesn’t mean that you should have multiple items because, seriously, how many bottles of mustard does your family really need?) Utilize credit cards with cashback or rewards programs, ensuring you pay off the balance monthly to avoid interest charges,” Melissa continued.

ikilledmyplant , Paulien Osse/Flickr (not the actual photo) Report

“Embrace minimalism to focus spending on what truly matters while reducing unnecessary material expenses,” the frugal mom added. “Prioritize saving and investing by automating contributions to savings or investment accounts for long-term growth through compounding interest. Reduce transportation costs by utilizing public transport, biking, walking, or carpooling when possible instead of relying solely on personal vehicles.”

mb4x4 , Marco Verch/Flickr (not the actual photo) Report

And she says she did lots of secondhand shopping when her daughters were little. “I always got compliments on their clothes because they were so unique,” she shared, noting that she’s been using most of these frugal habits since she started staying home when her oldest daughter was 2 and a half. “She will be 29 this year,” Melissa says.

tradlibnret , Alain Wibert/Flickr (not the actual photo) Report

Kittenbeautyy , dreamcat115/Flickr (Not the actual photo) Report

Caitlin also recommends keeping an eye on unit prices to see how much you’re paying for branding. “Name brands spend extra money on marketing and shelving costs, and they pass those fees onto the consumer by charging more per unit,” she explained. “So compare the unit prices for store brand items vs. the big brands. You may save a few bucks by choosing the store brand!”

“Of course, reducing discretionary spending on non-essentials such as travel, alcohol, and fashion can make a big difference as well, depending on how you spend your money and your personal preferences,” the expert added.

captain_vee , Andrew Neel/Pexels (not the actual photo) Report

Kittymarie_92 , Miles Goodhew/Flickr (not the actual photo) Report

Chocolatefix , cottonbro studio/Pexels (not the actual photo) Report

But she does believe it’s wise for all of us to live frugally, regardless of the state of our finances, because none of us know when our financial situation might change.

“Continuing to live at least somewhat frugally will make it easier if we need to adjust to spending less again at some point. Also, I’m a big proponent of giving generously,” Lydia says. “If we aren’t spending extravagantly, we have more to share with those around the world that haven’t been as privileged as we have been. And often living frugally means less waste too, which is better for the planet and all of us!”

ecoanal , Nikki Buitendijk/Flickr (Not the actual photo) Report

iridescent__wings Report

Darnbeasties , benjgibbs/Flickr (not the actual photo) Report

Caitlin also pointed out that you might regret choosing the cheapest option for something that you really enjoy. “For example, a $4 pastry from a coffee shop chain is going to be mediocre at best, whereas a $5 pastry from a local bakery or coffee shop that makes everything in house is likely to be excellent! So when the cost savings aren’t hugely significant, but will impact your enjoyment immensely, I recommend you go for the splurge every once in a while rather than settling for something sub-par,” she shared. “Something mediocre might not satisfy your craving and could leave you reaching for something else to feel more satisfied!”

chicklette , nakhon100/Flickr (not the actual photo) Report

TubedMeat , Brett Jordan/Pexels (not the actual photo) Report

“So if you’re choosing to avoid hanging out with friends and family because of the cost of dining out or the cost of gas or travel, without actually having a good reason to save that money, well, I’m not sure if that is really worth it in the grand scheme of things,” the nutritionist says. “It’s important to bring balance, even to the concept of frugality!”

curtludwig , Burak The Weekender/Pexels (not the actual photo) Report

ForgedByLasers , Oladimeji Ajegbile/Pexels (not the actual photo) Report

TubedMeat , Anand Nav/Flickr (not the actual photo) Report

drupadoo , Antoni Shkraba/Pexels (not the actual photo) Report

“For example, sometimes, it makes more sense to pay more for something that will save me time, because it’s actually more financially wise for me to use that time saved and invest it in my business,” she explained. “In the end, I’ll make more money that way. I think that’s always something to consider when you think about saving money.”

Public-Requirement99 , Bill Abbott/Flickr (not the actual photo) Report

winston198451 , picjumbo.com/Pexels (not the actual photo) Report

But she added that not every financial plan or frugal living plan is right for everyone. “You have to decide what is right for you and your family and learn the art of compromise. If you really want to keep one thing, then you might have to give up something else,” the frugal mom shared.

LRGeezy , Antoni Shkraba/Pexels (not the actual photo) Report

Weird_Squirrel_8382 , CORGI HomePlan/Flickr (not the actual photo) Report

But we also have to be realistic about how much groceries cost nowadays. “Gone are the days when you could slash your food budget in half with a few simple tricks,” the nutritionist noted. “Food costs in the USA have increased exponentially, and in order to choose nourishing meals that fill our bellies, we may have to incorporate these tricks while also increasing our food budgets to accommodate the increases in cost.”

evey_17 , Andrea Piacquadio/Pexels (not the actual photo) Report

tumblrgrl2012 , osseous/Flickr (not the actual photo) Report

“I definitely don’t mean to demonize these foods at all, but a full meal at a fast food restaurant is still likely to cost you $10, so unless it’s a special treat, that’s still not super budget-friendly,” she explained. “If this is a meal that you really enjoy, I would treat it as just that - something you’re eating because you enjoy it! But if you’re only choosing it because it’s cheap, you might be better off with a delicious homemade sandwich and potato chips!”

Global_Fail_1943 , Ellen Kabellen/Flickr (not the actual photo) Report

JahMusicMan , Sara/Flickr (not the actual photo) Report

Terrible_Opposite_67 , Joel Kramer/Flickr (not the actual photo) Report

Follow Bored Panda on Google News!

Follow us on Flipboard.com/@boredpanda!