A man, for instance, sought advice online after he refused to pay for his wife’s vacation as she had been financially irresponsible. The author shared that his family was planning a trip to Europe, but his wife couldn’t afford the plane tickets because she was focused on paying off her credit card debt. Keep reading to learn the entire story and why the author refused to chip in for his wife. And don’t forget to check out our interview with a chartered accountant with expertise in financial planning and tax advisory.

Many couples choose to combine their finances, but this can sometimes lead to disagreements about how the money is managed

Share icon Image credits: YuriArcursPeopleimages/Envato (not the actual photo)

A man shared how he decided to separate his finances from his wife after she accumulated significant debt

Share icon Image credits: YuriArcursPeopleimages/Envato (not the actual photo)

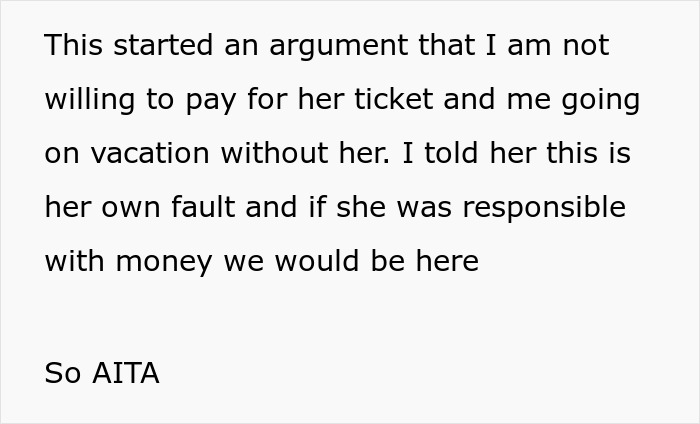

Image credits: Electronic_Bus7936

Couples with combined finances must prioritize shared decision-making to manage their money effectively

Share icon Image credits: Tima Miroshnichenko/Pexels (not the actual photo) A couple shares so many aspects of their lives, from their dreams and daily routines to their homes and responsibilities. However, one of the most significant things spouses can share is their finances. How a couple manages money together can deeply impact their relationship. In order to gain deeper insights into how couples should manage their combined finances, Bored Panda spoke with CA Khushboo Dugar, a seasoned professional from India. Khushboo believes if partners work together, they can accomplish great things in life. “When couples pool their resources together for common goals, they are able to find better investment opportunities. Let’s say a particular option was out of reach for an individual, but with a joint financial approach, they might be able to diversify and improve their portfolio.” Speaking about the benefits of having savings together, she adds, “When you have a combined income, you can better manage unexpected expenses, such as medical emergencies or job loss. The good part about this is that it doesn’t put strain on one partner alone. Sharing financial responsibilities fosters a sense of security and trust.” A recently published study points out, “In close relationships, people often provide support to their partners to help them thrive and pursue life’s opportunities. This is especially true in romantic relationships, characterized by high interdependence, where individuals interact frequently and have considerable impact on each other’s behavior across a wide range of domains.” Imagine a person is skilled in budgeting, and they help their partner improve their financial habits by creating a joint savings plan. By doing things together, the couple might be able to save for a down payment on a car faster than they expected. However, things are not always smooth sailing. Highlighting the downsides of having a joint account, Khushboo mentions, “There are individuals who can’t stick to a strict budget. If you and your partner are not on the same page about your finances, it could lead to misunderstandings. Let’s say if one partner earns more than the other, there might be an ego clash.”

Partners should contribute to shared expenses in proportion to their income

Share icon Image credits: Tim Douglas/Pexels (not the actual photo) Khushboo firmly believes that having a plan is important when you combine your incomes. “Financial responsibilities in a partnership can be managed by dividing them according to each partner’s efforts and time involvement. Each person can contribute fairly based on their salary and personal circumstances. For example, one partner might handle a larger share of the household expenses if they have a higher income, while the other might contribute proportionally to their means.” It’s equally important for couples to set aside savings for their personal goals. It could be for a luxurious spa day, to buy your favorite game station, or to pursue any other personal interests. “To achieve a balance, couples can agree on a fixed percentage of their combined income to cover shared expenses such as bills, rent, or joint savings goals. The remaining funds can then be allocated for personal use, allowing each partner to enjoy their individual pursuits without compromising their financial responsibilities.” Every couple should discuss and do what works best for them. In this particular instance, people online felt the husband was being too harsh on his wife. What do you think? Do you have a joint account with your spouse? How do you manage things?

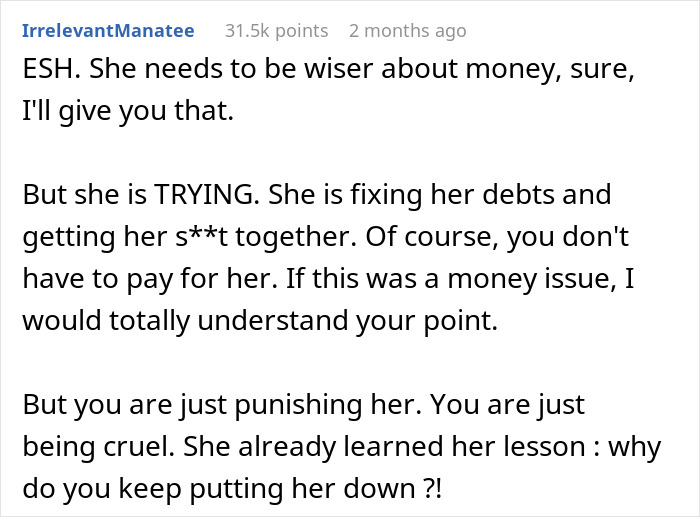

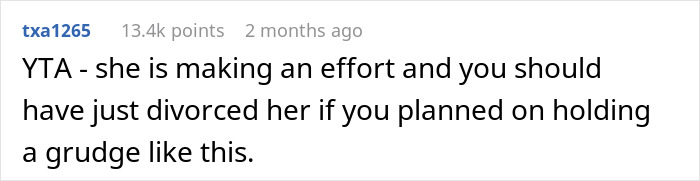

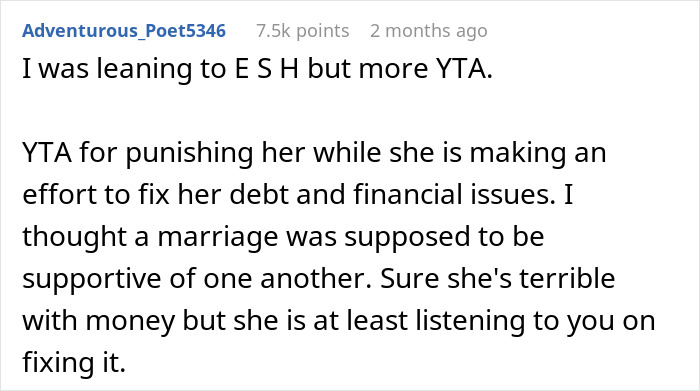

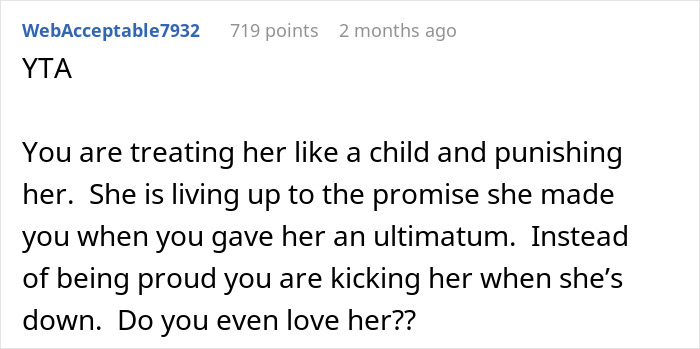

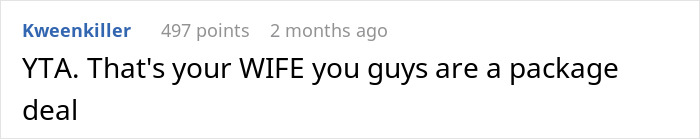

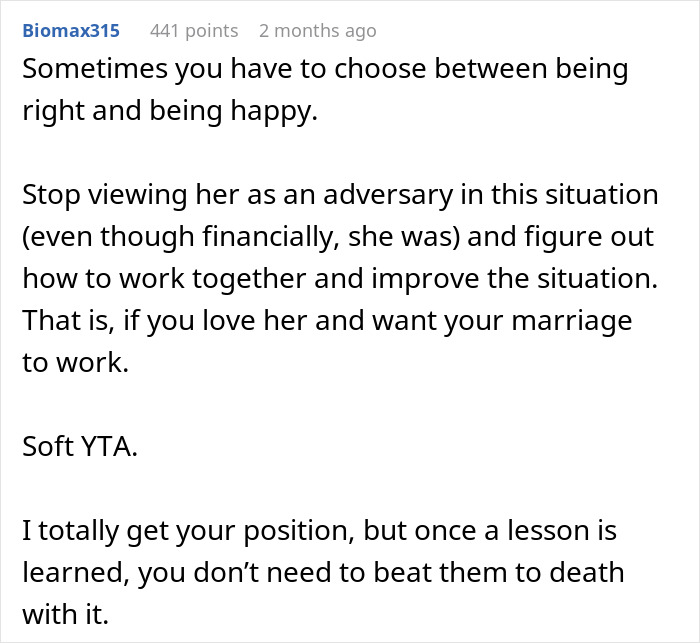

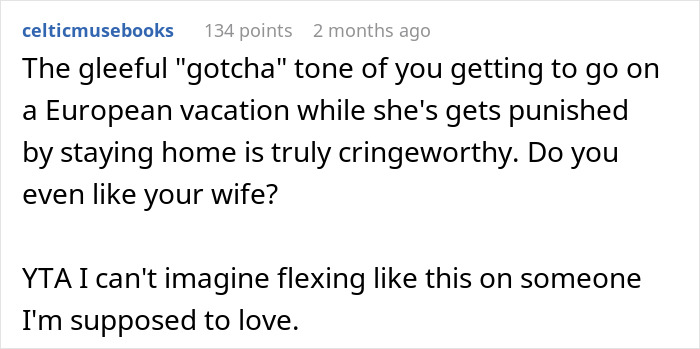

Many people online felt the husband was being unfair for not covering his wife’s share of the trip

On the other hand, others believed the wife was accountable for her actions, and the author wasn’t obligated to fund her vacation

Anyone can write on Bored Panda. Start writing! Follow Bored Panda on Google News! Follow us on Flipboard.com/@boredpanda!