Like this parent, who took it upon themselves to right the wrong of a grandfather. After he left his grandson a $70k car and only $4k cash to each other grandkid, the parent’s children decided it wasn’t fair. So, the parent of the lucky kid asked the Internet whether it would be fair if they gifted his college fund away to the son’s sisters and cousins if he didn’t agree to sell the inherited car. Bored Panda contacted Nathan Astle, a financial therapist and couples and family therapist. He explained the repercussions the mother’s actions might have on the mother-son relationship in the future and why families should talk about inheritances earlier.

A 17 Y.O. teen inherited a $70k car from his grandfather, and this set off some serious family drama

Share icon Image credits: Mr.choppers / wikipedia (not the actual photo)

His parents and aunt felt it was unfair to the other grandkids, so they pressured him to sell it and share the money with his sisters and cousins

Share icon Share icon Image credits: Pixabay / pexels (not the actual photo)

Image credits: No_Advertising_2814

‘Unequal’ wills can lead to long-term resentment in some families

Share icon Image credits: Karolina Kaboompics / pexels (not the actual photo) Experts recommend talking with the people to whom the money and assets will be left beforehand. Leaving a bigger sum or an asset that is worth more to one child/grandchild signals to the others that he or she might’ve been the favorite. That only leads to resentment and long-lasting family feuds, so it’s better to address it while all family members are still present. Financial Therapist Nathan Astle agrees. “Inheritances so often come with complicated feelings,” he told Bored Panda. “That is why it is important to have these conversations often and, ideally, before someone passes away.” He explains that the mother has a legal claim on her child’s possessions while he’s underage. However, “There is an important piece of whether the relationship with her son will suffer if she decides to sell the car,” Astle adds. According to him, inheritances are tricky in general. “It can really damage relationships if things like wills, boundaries, and communication [aren’t] spelled out clearly. The resentment can really build if things don’t feel fair or if the money is attached to specific behaviors. Money should not be used as a tool of power in family relationships.” In this particular case, the mother threatening to cut the child’s education fund is already hurting the relationship. “This most certainly will lead to loss of trust on the son’s part and likely drive him further away from the family,” Astle explains. “Especially if other members of the family are resenting him for getting the bulk of the inheritance value in the form of the car. This is a time for mom to protect her son from money vultures, potentially including herself as well.”

An inheritance does not have to be equal to all members of the family

Share icon Image credits: Pixabay / pexels (not the actual photo) Money and family really don’t mix well sometimes. It’s hard to leave a will that every single person in the family would be happy with. But does a will mean that the estate should be allotted to all family members equally? Not necessarily. As one person in the comments observed, “The point of a will is not a fair distribution of assets.” One thing to note here: ‘fair’ doesn’t mean ‘equal.’ What’s fair to one person might seem completely unfair to another. The reality is that many parents and grandparents choose to leave ‘unequal’ wills. A 2018 survey by Merrill Lynch found that two-thirds of Americans who are 55 or older would leave more assets to a child who provided them care in their later years. There are different models people follow when writing a will. Some leave everything investment-related to one child, real estate to another, and things like antique jewelry or cars to a third. Relationships also play a part: in this story, the grandpa might’ve just had a better relationship with the grandson than he did with his other grandchildren. Bogart Wealth writes that some parents/grandparents might feel like they already met the financial obligation to one child/grandkid. Perhaps they funded one’s private school tuition already or one child might have plans to attend an Ivy League school and needs the financial support.

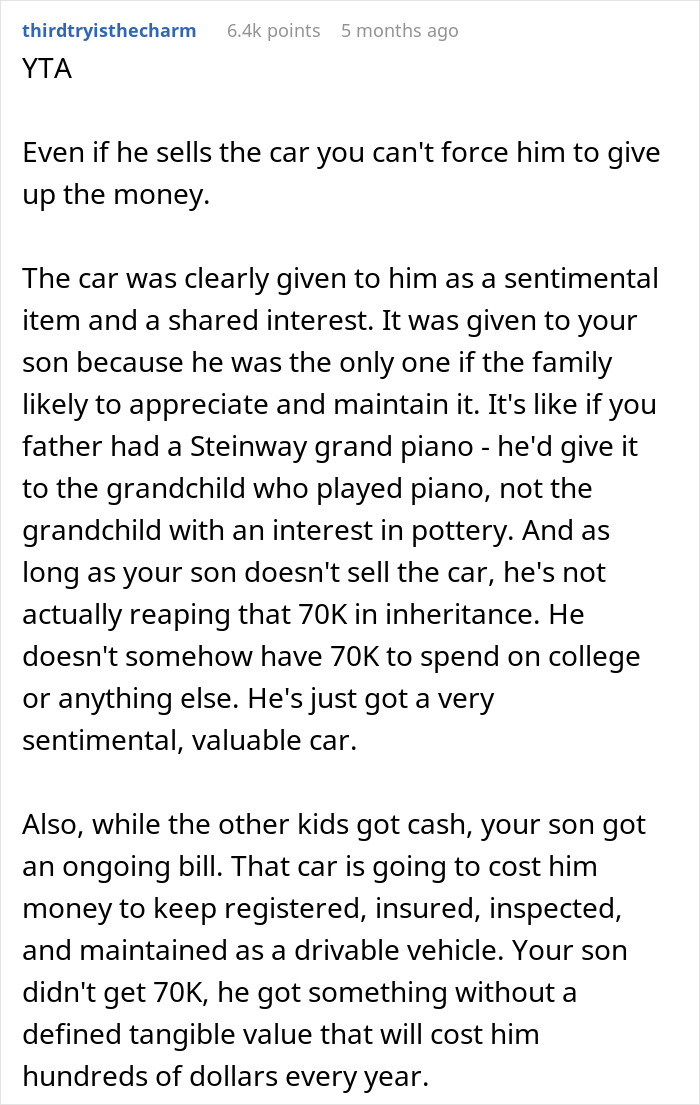

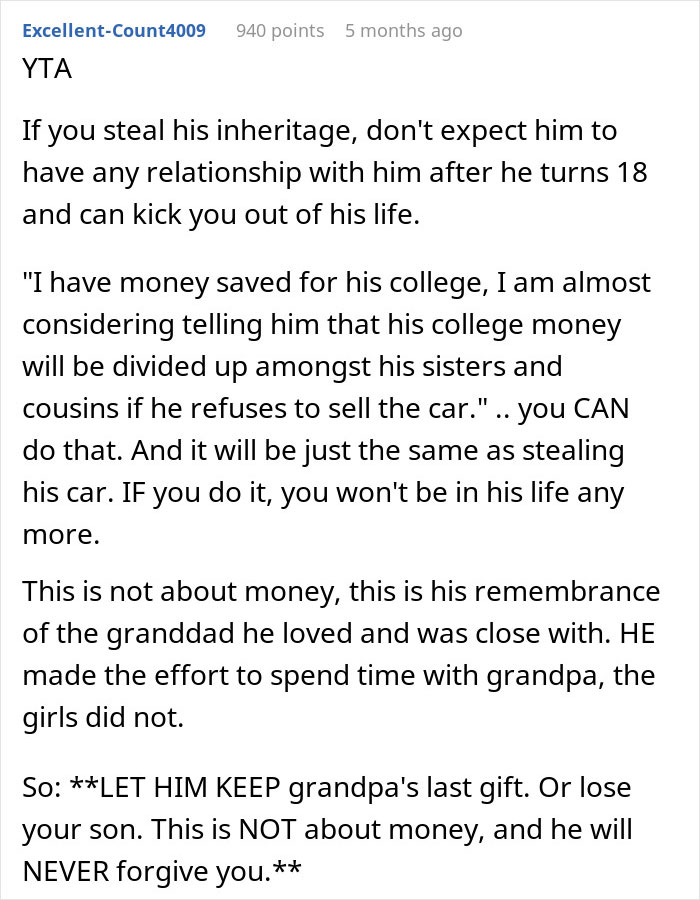

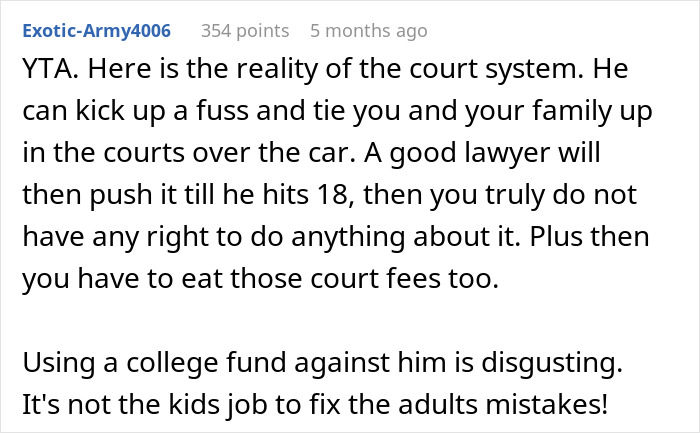

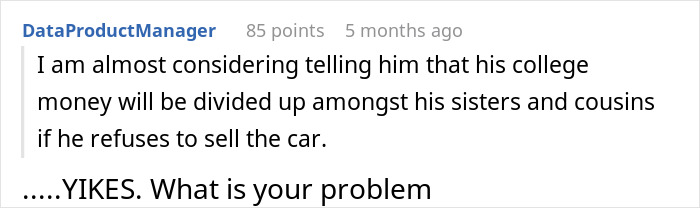

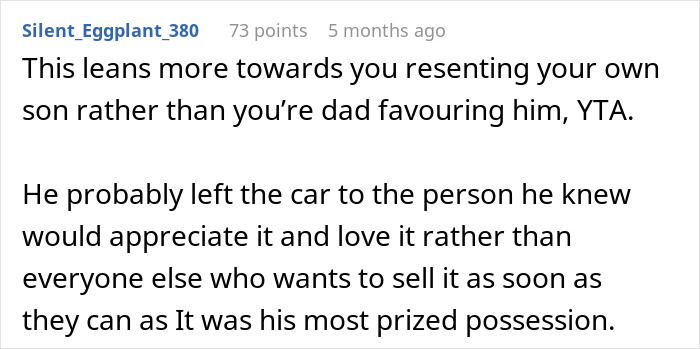

“This is not, never was, and never, ever will be your decision to make,” one netizen wrote, echoing the sentiments of many others

Share icon

Share icon Share icon

Share icon Share icon Share icon Share icon

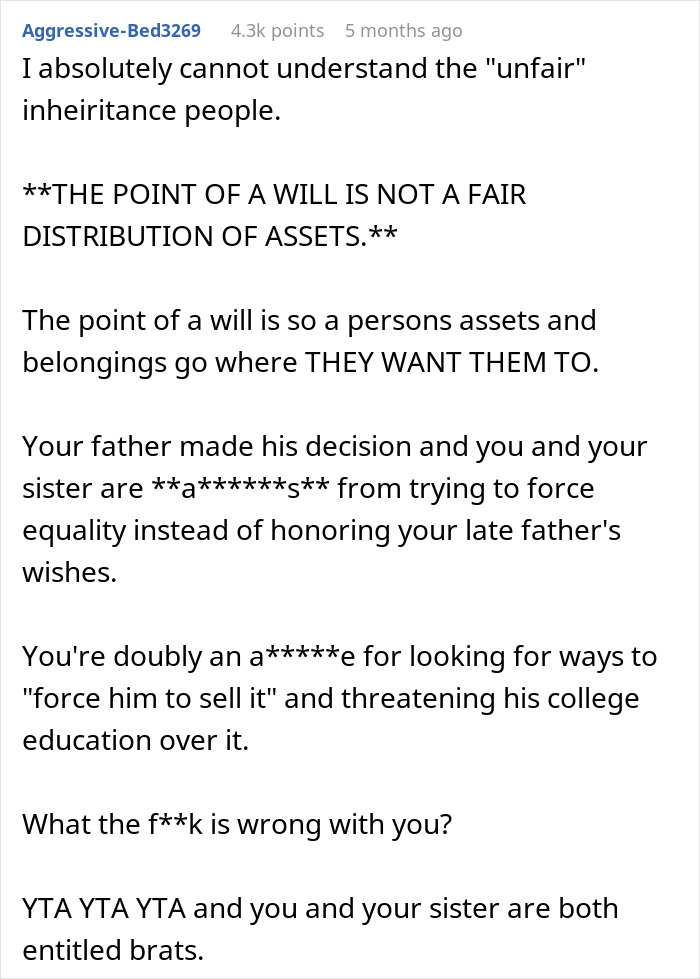

However, others agreed with the parent that the will was unfair to the other grandkids

Anyone can write on Bored Panda. Start writing! Follow Bored Panda on Google News! Follow us on Flipboard.com/@boredpanda!