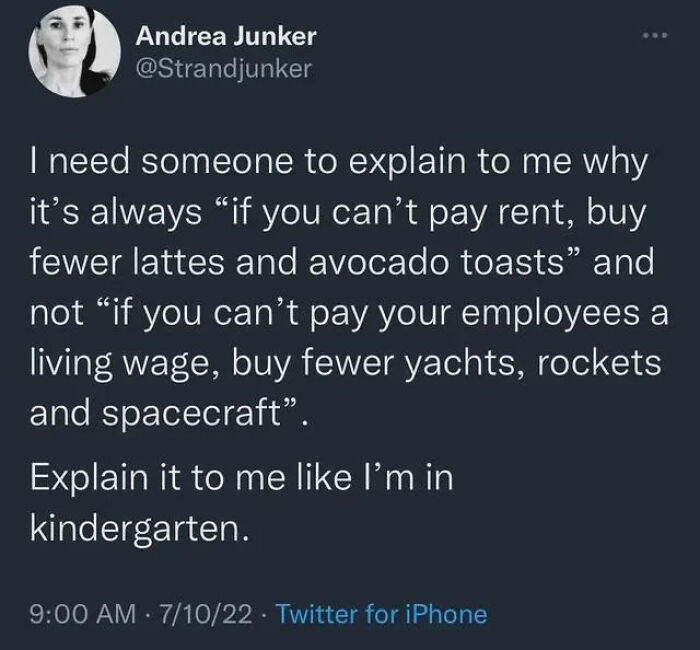

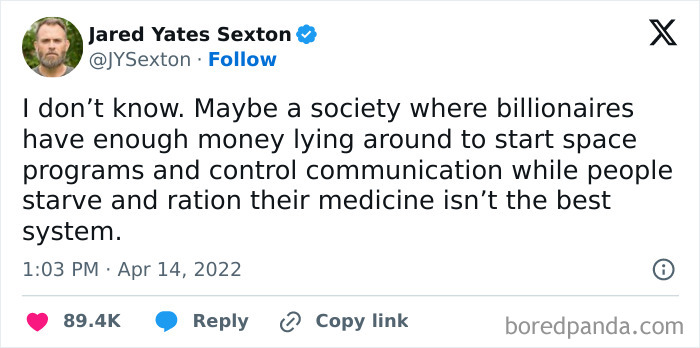

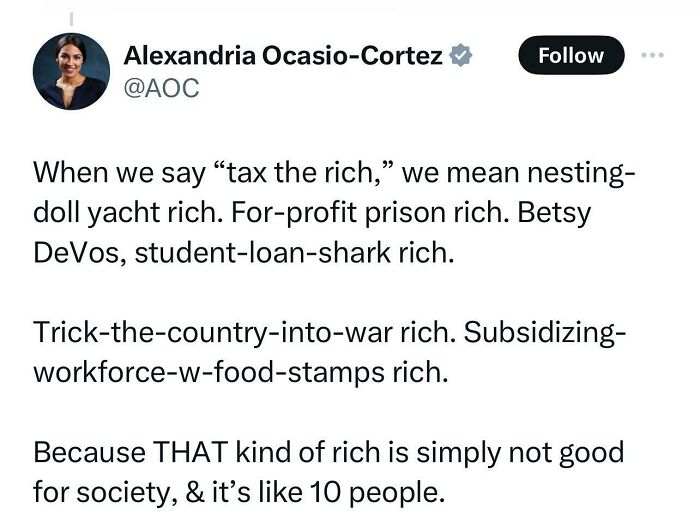

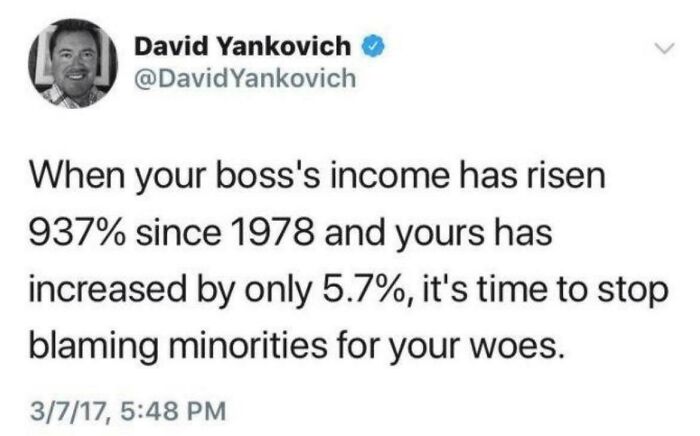

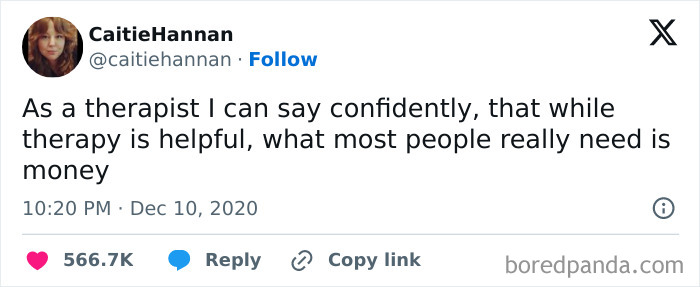

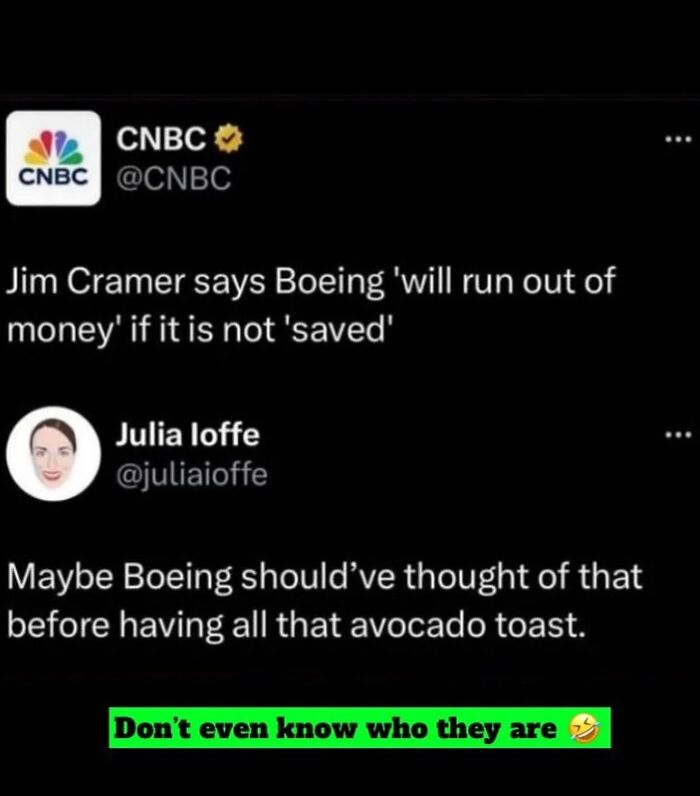

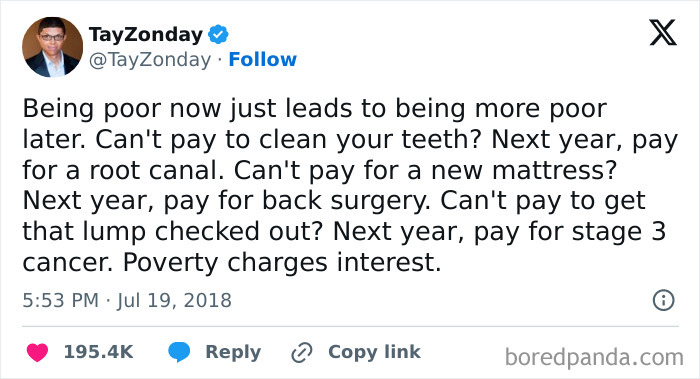

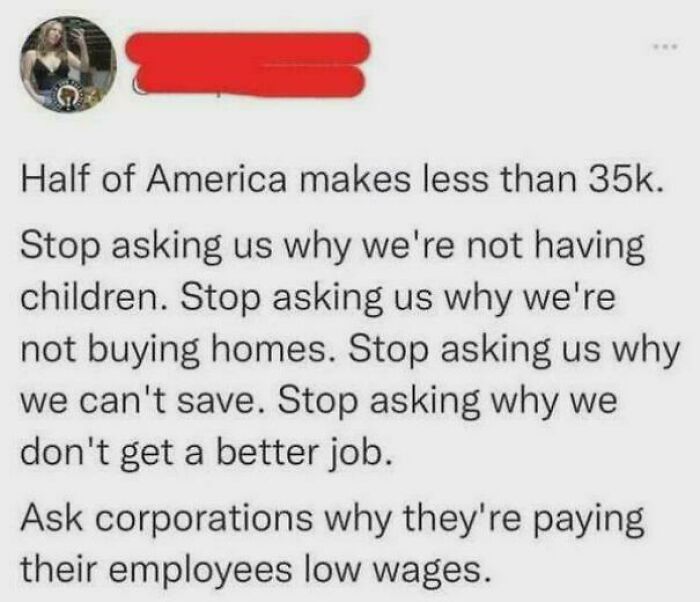

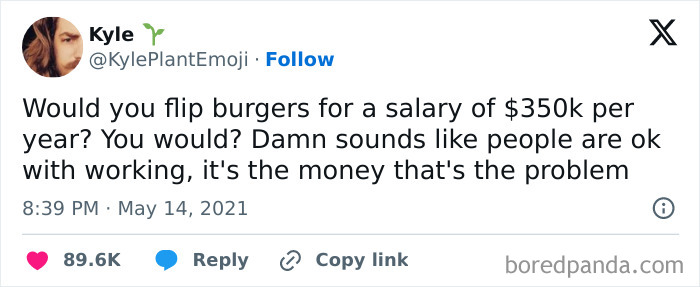

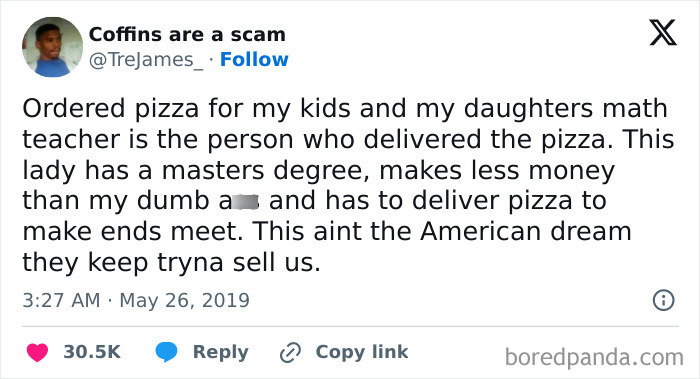

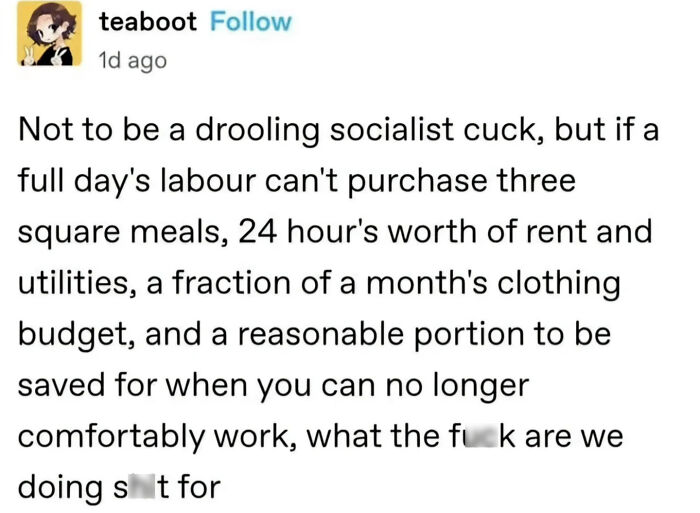

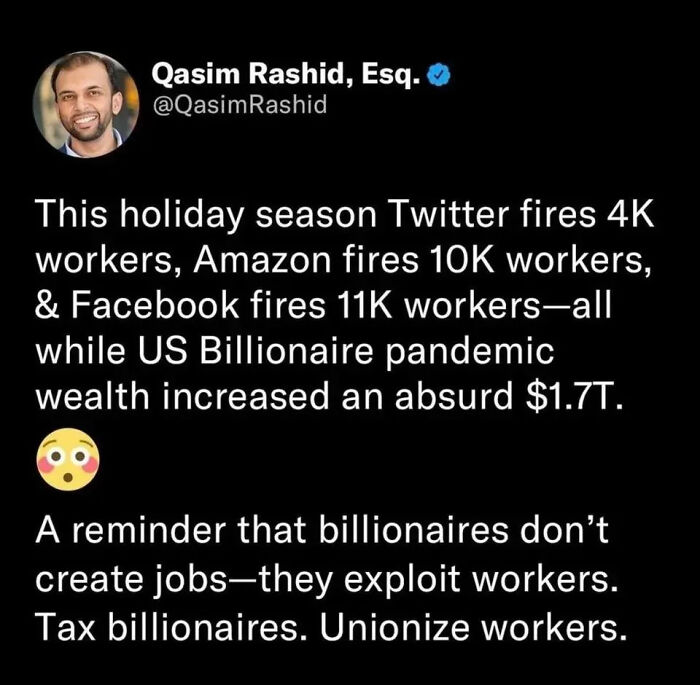

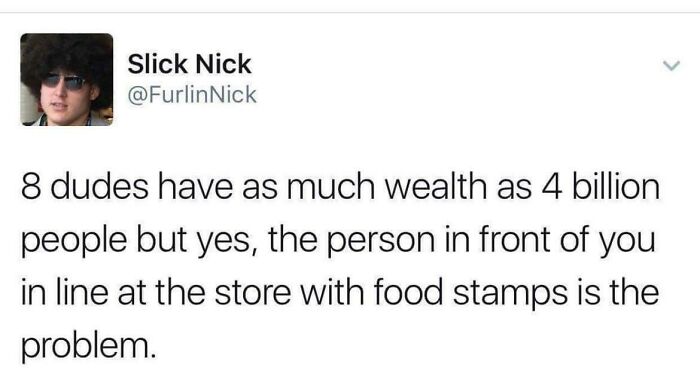

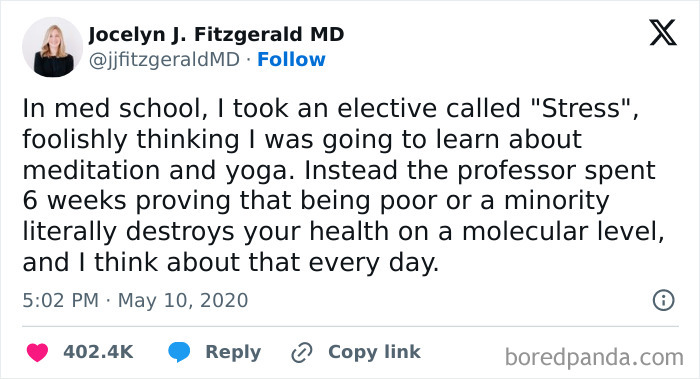

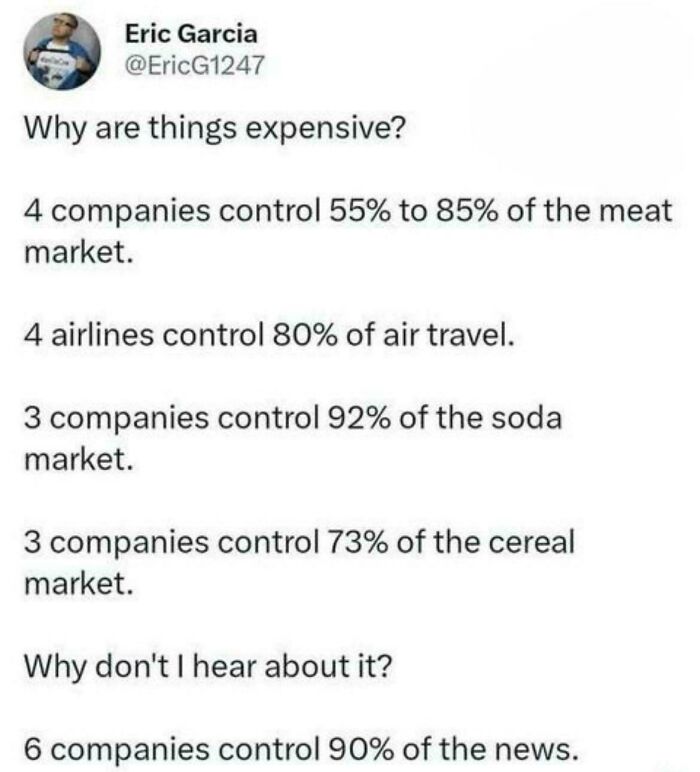

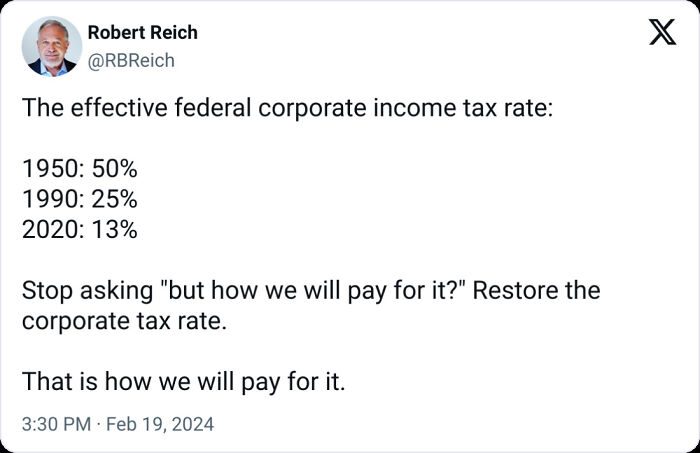

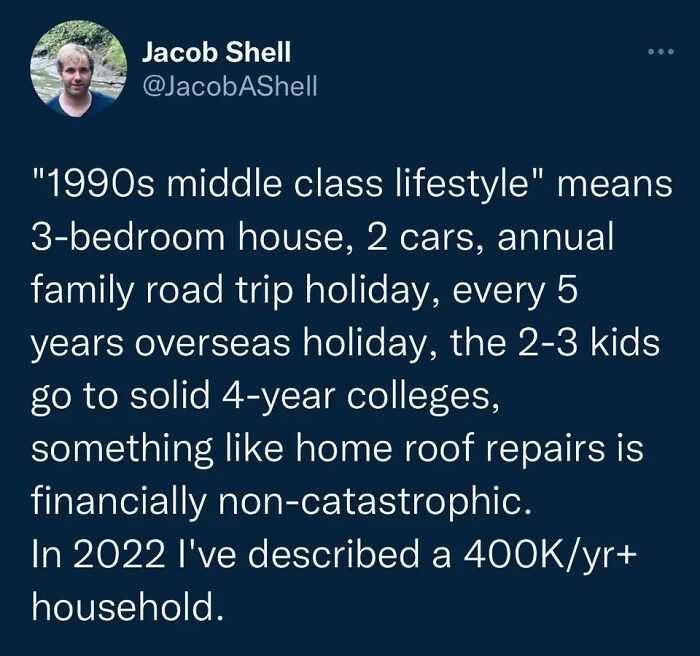

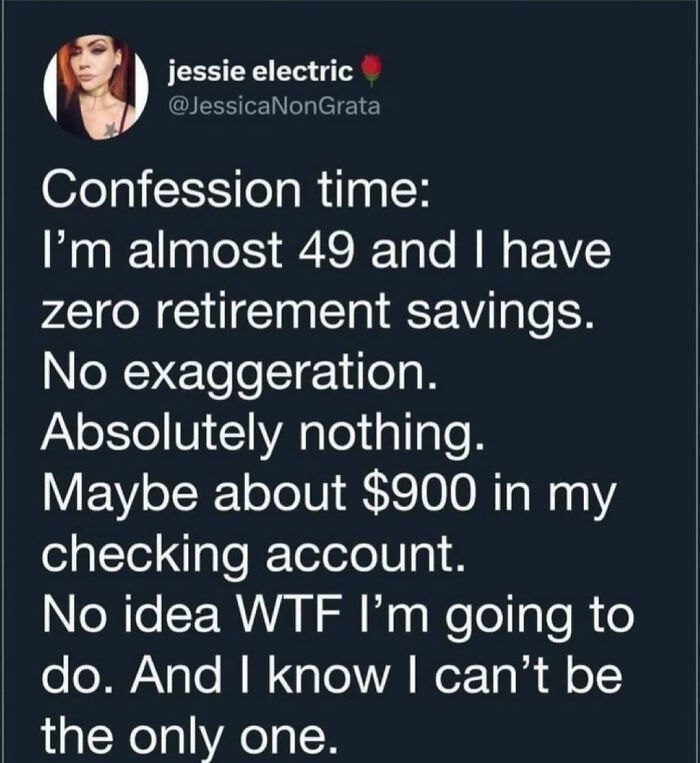

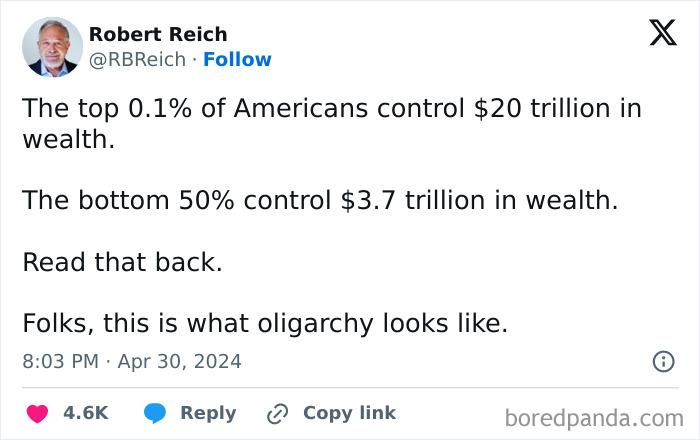

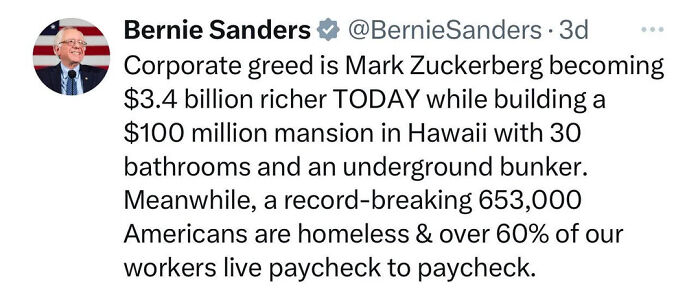

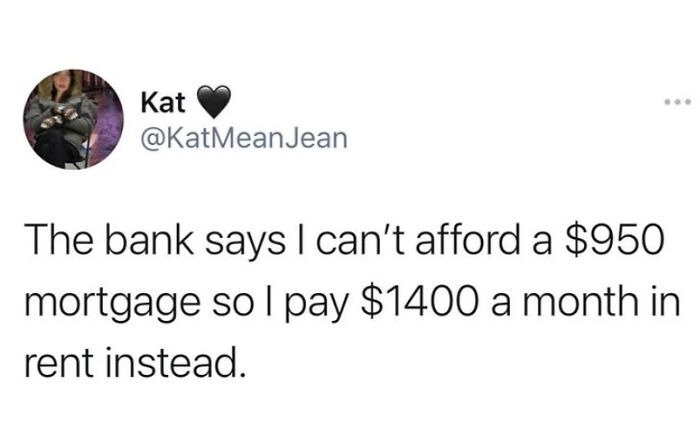

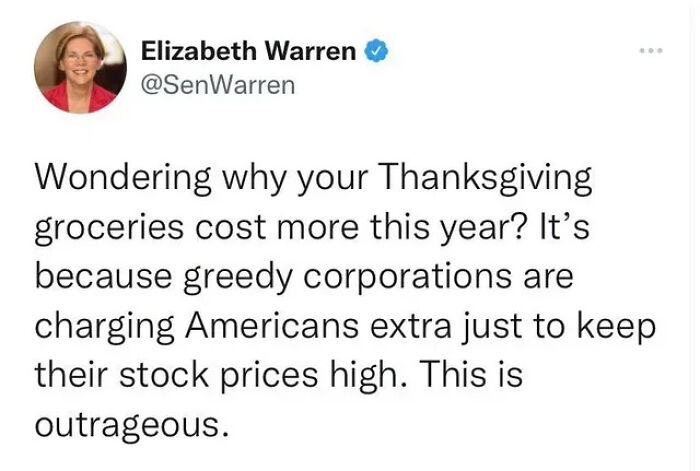

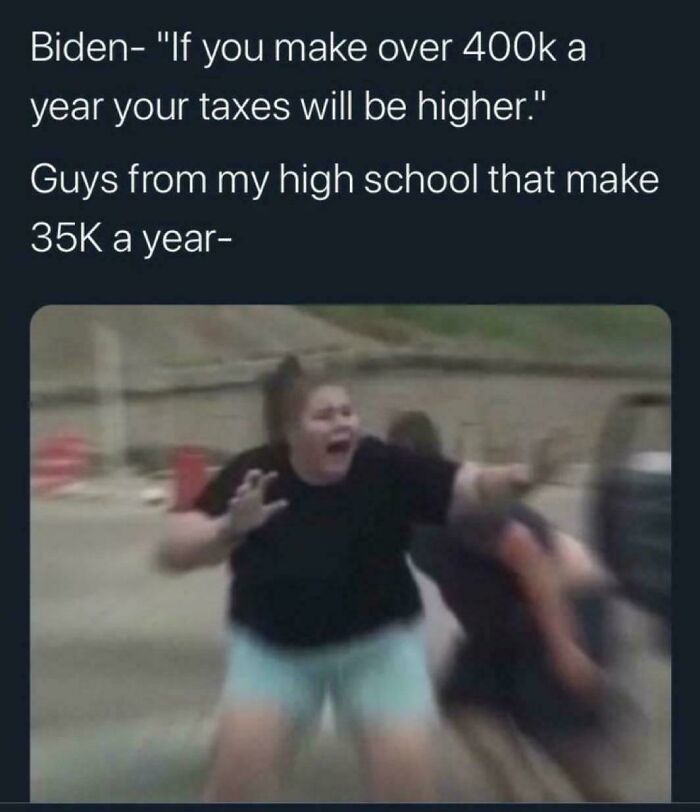

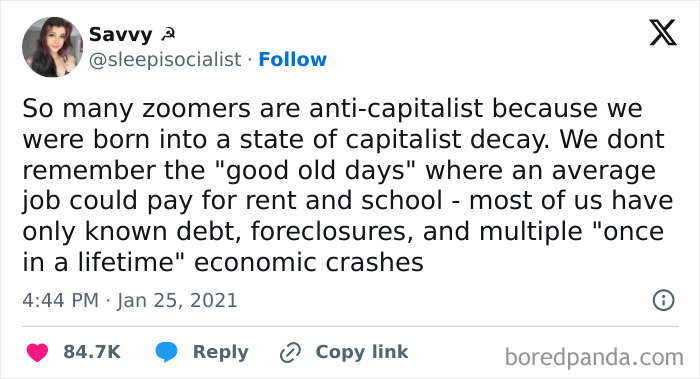

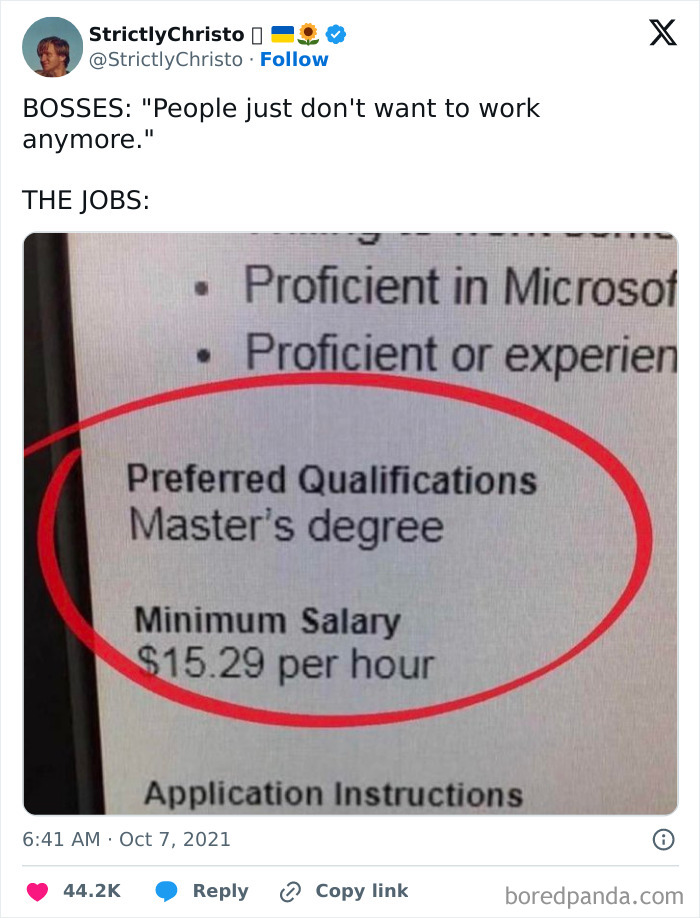

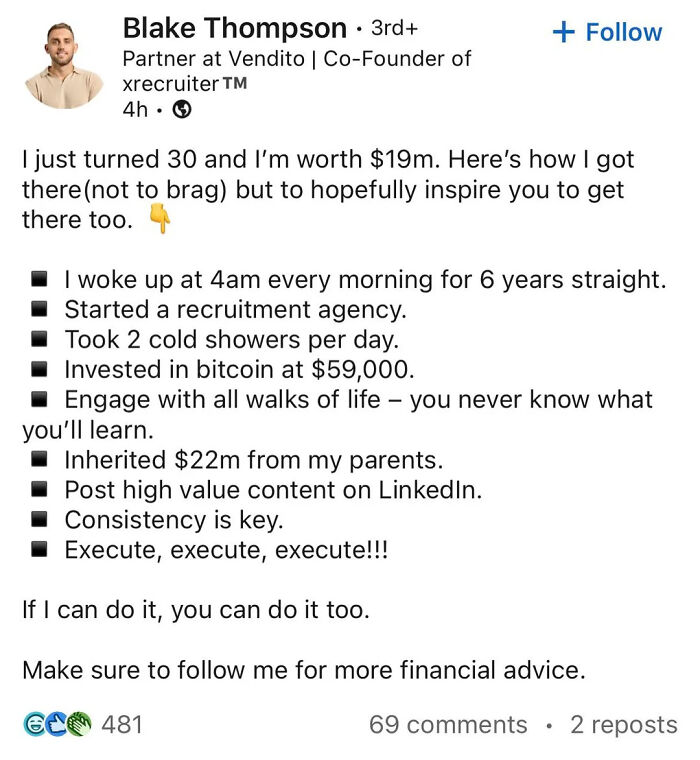

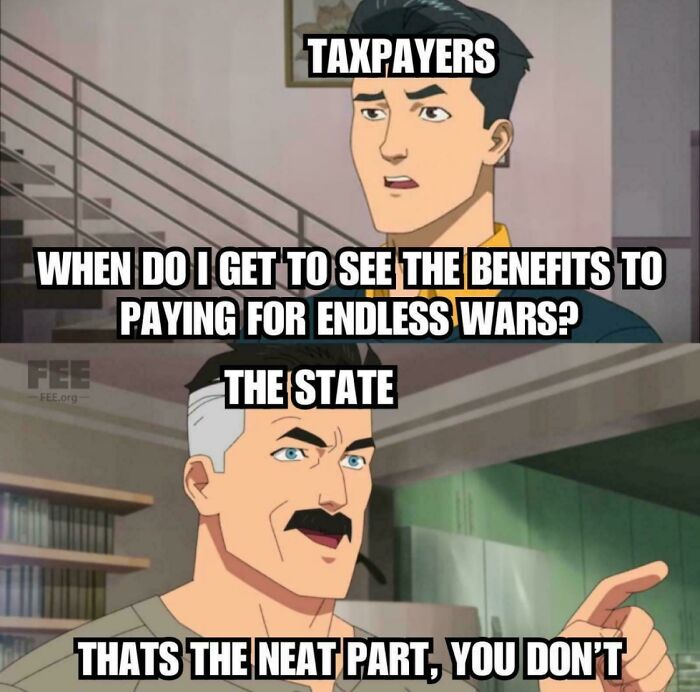

There are quite a few reasons why they believe this: diminished excess savings, plateauing wage gains, the restart of student loan payments, an uptick in subprime auto and millennial credit card delinquencies… The list goes on. But to find out what the people think of the economy and how they’re navigating its challenges, the subreddit r/FluentInFinance is the place to jump into. With 326K members, this vibrant community is a hub for insightful discussions, advice, and, most importantly, memes on all things money. The University of Michigan also raises them (and other similar ones) to calculate the Consumer Sentiment Index, an economic indicator measuring how people feel about the economy. That survey and others demonstrate there is a pervasive sense of disconnect between the overall economic picture and how people feel about the economy. Despite slowing inflation, a healthy labor market with record-low unemployment, and stocks that remain in a bull market, consumer sentiment remains below pre-pandemic levels. (Economists polled by Reuters had forecast a preliminary reading of 72.0.) Before the coronavirus pandemic, the index stood at 101. The top tenth of households by wealth are worth $7 million on average, while the bottom half hover around $51,000 on average, according to the Institute for Economic Equity at the Federal Reserve Bank of St. Louis. Since 2018 — including during and after the recession sparked by COVID-19 — economic reporting has taken on an increasingly negative tone, despite economic fundamentals strengthening in recent years, the analysis found. Follow Bored Panda on Google News! Follow us on Flipboard.com/@boredpanda! Please use high-res photos without watermarks Ooops! Your image is too large, maximum file size is 8 MB.